2. Customer voice

Customers are at the centre of everything we do and we pride ourselves on delivering valued services. The regulatory proposal is the perfect time for us to engage with customers on what they value and prioritise, so this can feed into our five year plans for 2024-29. Our engagement program has focused on talking to customers about what is important to them and providing the tools to give informed feedback on our strategies and plans. We have specifically incorporated key customer priorities on the future network, addressing the replacement wall, customer service improvements and tariff reform into our plans.

Our engagement has been significantly more extensive and longer than what we undertook in the 2019-24 determination. This reflects an industry-wide recognition that customer involvement in the decision making process can help steer a business towards outcomes valued by our customers. We also see that our customers are more active and engaged in the energy market, particularly given the high levels of investment in rooftop solar panels. Energy is also a household topic as electricity systems transition from fossil fuels to cleaner sources of energy.

In this chapter, we identify our approach to engagement, the feedback we have received and how we have implemented customer preferences in our five-year plans.

2.1 Engagement to date

Our engagement program has been directed at understanding what our customers value, and what they expect us to prioritise. A key point of difference is that our engagement has moved from seeking the feedback of informed advocates to talking directly to customers about their experiences with our services.

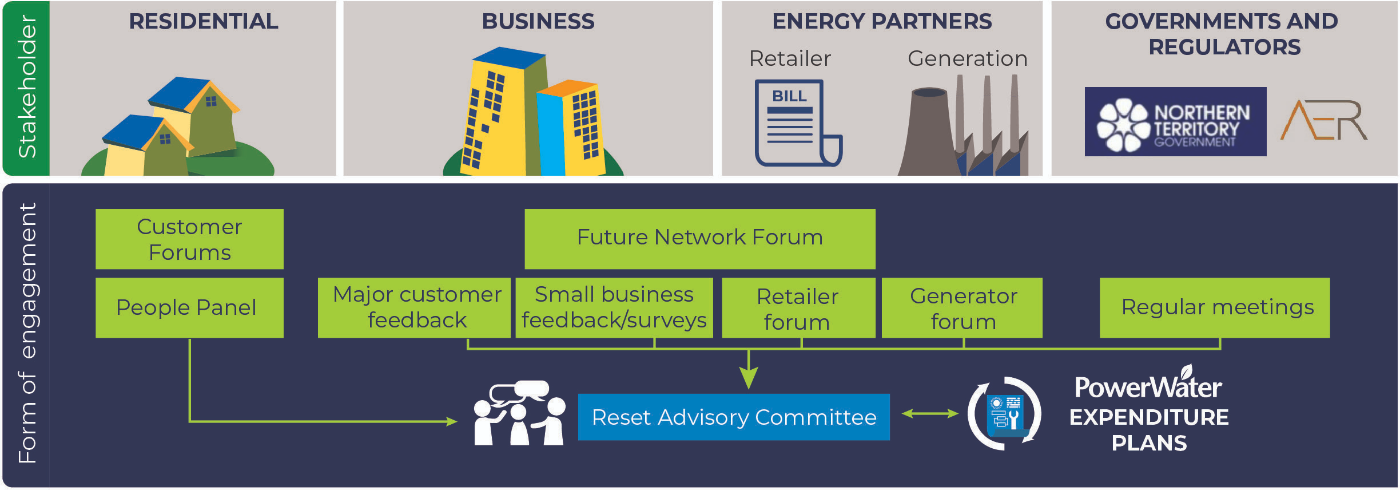

Figure 14 shows that we have involved customers, energy partners, and governments and regulators in our engagement approach through a series of forums and panels. To provide an overarching frame to bring together feedback, we also established a Reset Advisory Committee (RAC) consisting of informed advocates, major users and residential customers.

Figure 14 – Stakeholder engagement segments and forums

Residential Customers

We have made a concerted effort to talk directly with the customers that use our electricity services. This includes establishing People's Panels in both Alice Springs and Darwin. The panels are a representative group of about 20 residential customers in each region. Over two weekends in November 2021 and April 2022, the People's Panels reflected on their experiences as a customer, and what we could do better. The Panels also provided a clear vision of Power and Water in the future and the priorities they thought we should pursue. We have also sought to talk to specific customer groups about their experience including Culturally and Linguistically Diverse (CALD) customers and a Youth Forum.

Business Customers

We have also sought to involve businesses in our engagement activities. Businesses are short on time, and so we sought their views through a survey that aimed to capture the key values and issues they feel are important.

The customer preferences we have identified in this Draft Plan largely reflect the findings of our residential customers through our People's Panels. We recognise that we need to engage more intensely with our business customers in the months ahead to understand if they share the same priorities.

Energy partners

While our customers have been the focus of our engagement, we have been mindful that we are only one element in the ‘end to end’ electricity system. Our customers expect us to work with generators and retailers to provide a seamless service that puts the customer experience at the forefront. We recognise that this means we need to ensure our plans are compatible with the systems and vision of generators and retailers, and that together we improve the overall customer experience. We have held retailer forums to discuss common issues including improving customer service.

Governments and regulators

Governments and regulators play an important policy and oversight role in our business. The NTG is both our shareholder and legislator. We must ensure our plans align to NTG strategic direction, and this has been a focus of our engagement. We have been also meeting regularly with the AER in pre-engagement on the regulatory proposal and our engagement approach to date. The AER has a dedicated Consumer Challenge Panel that observes our engagement activities and report back to the AER. Finally, we need to discuss our plans with our local technical regulator, the Northern Territory Utilities Commission, who is responsible for setting our local technical and performance standards.

Reset Advisory Committee

Our Reset Advisory Committee (RAC) provides us guidance on bringing together the preferences of different customer segments, ensuring there is a line of sight between our expenditure proposals and customer preferences, and advising on the questions we should be asking stakeholders.

The RAC is comprised of informed consumer advocates with previous experience in regulatory proposals in the National Electricity Market (NEM), local NT customer advocates and representatives from our customer forums. We have not sought to get approval from our RAC for our expenditure plans through a series of deep dives. Such an approach may have excluded the voice and lived experiences of our customers, due to the complexity of material that would need to have been presented. For this reason, we have not sought “fast tracking” of our regulatory proposal by the AER.

The RAC has met at regular intervals since April 2022, and has provided guidance on what questions we should ask in this Draft Plan.

2.2 Topics covered in engagement sessions

Our engagement approach has started from the lens of our stakeholders, focusing on topics and issues of interest to the group, and broadening the topics as information and knowledge expands. We considered alternative approaches such as deep dives into our building block plans but considered this would not provide the foundations for meaningful and informed feedback.

We have sequenced our discussions in four steps:

- Baseline knowledge – The first step has been to ensure our stakeholders have a baseline knowledge of Power and Water’s business and our role in the regulated electricity network. We also wanted customers to have a baseline understanding of the services we provide and the activities we perform. We also developed materials and sessions that helped explain the AER regulatory process including how our regulatory proposal impacts on electricity costs, bills and services.

- Exploring themes – The second step in the process was to identify topics and themes that were important to the stakeholder. We found that all our stakeholders shared a passion and enthusiasm on how renewables will be integrated into the energy system, and our role in facilitating this transition. This led to us hosting two Future Network Sessions in November 2021 and June 2022. A further theme was the strategic challenges that lie ahead for Power and Water and how we can offer an affordable and reliable service in the long run. This theme also explored our journey to date and the role of benchmarking.

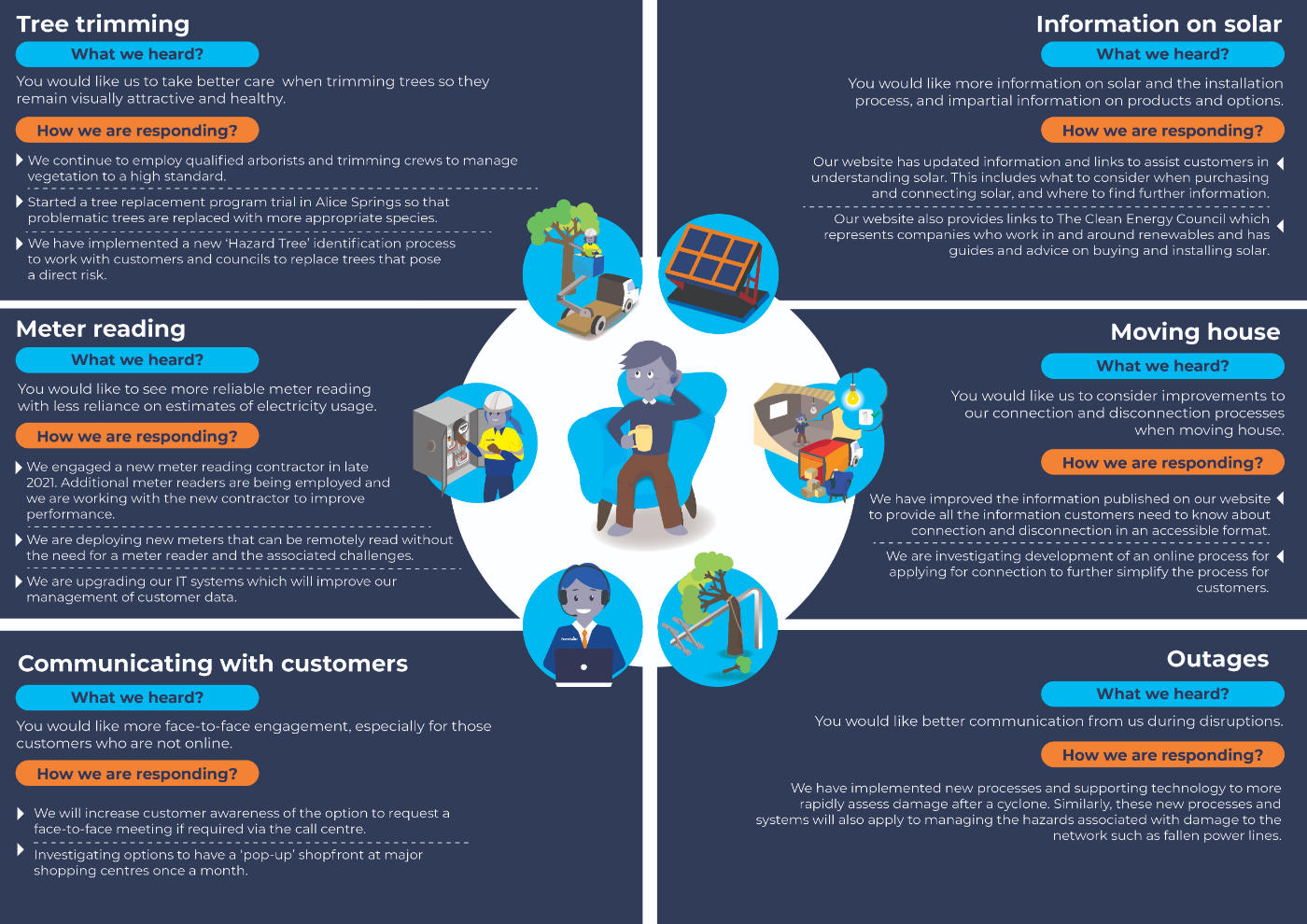

- Identifying pain points with our current services – Using the customer journey framework discussed in Chapter One, we explored areas of our business where customers felt we could improve. Figure 15 on the next page shows the key issues and our discussions with customers on avenues for improvement

- Identifying values, vision and priorities – The fourth step was to understand our customers values, and the relativity of these values. The key to this conversation was the trade-off between affordability and service quality, particularly long-term outcomes. In this context, we were able to understand that customers were not willing to pay more for services except key priorities such as the future network. This conversation also led to a better understanding of our customers’ vision for Power and Water in the NT.

The Draft Plan provides an opportunity to contextualise how customer feedback has influenced our strategic thinking and expenditure plans. For example, our initial plans presented to the People’s Panels in March and April 2022 did not include automated solutions to unlock solar and did not seek to plan for an expected uplift in replacement beyond 2030. Based on the People’s Panels recommendations, we have now included these specific expenditure items in our 2024- 29 expenditure plans. A further example is the reductions in our bottom-up plans compared to our initial estimates to lower the revenue in the 2024-29 period.

The final steps in our engagement approach will be to delve deeper into our expenditure plans and revenue as part of our engagement sessions after this Draft Plan is released. By bringing our customer groups on the journey over the last nine months, we consider they are in a better place to provide informed feedback on our plans. In future engagement sessions, we will focus on topics that are both material and can be influenced by customer feedback.

2.3 Our customers’ vision for Power and Water

In our stakeholder consultations, we focused on unpacking what our customers thought about the future and the role our network should play in it.

A key theme has been about embracing the renewables future. Our customers wanted us to facilitate and actively support the shift to renewables. Our Darwin People's Panel thought we should even go further by leading change on renewables. This was also central to the views of broader stakeholders in Future Network Forums. There was a view that Power and Water needed to have a Future Network Strategy that sets the network up to facilitate growing renewables well beyond 2030.

A further theme was about helping customers in broader decisions on energy – from how to use power efficiently, to decisions on solar, batteries and electric vehicles. In particular, our customers felt that our active involvement in the energy industry was vital in a changing market where customers had to make decisions without a trusted advisor.

Our Panels also talked about improving our communications, including platforms that are more active and responsive. There was a view that we had to improve the diversity of our communications so that we were accessible in all forms used by customers – from face to face, to telephone to social media. Inherent in these discussions was a view that Power and Water should keep pace with modern technology, but also accommodate traditional modes of communication.

In our discussions with stakeholders, there was much emphasis on not letting the network run down, with the memory of the Casuarina zone substation failure in 2008 front of mind. Our customers wanted us to think ahead on these issues.

Figure 16 provides the vision designed by each Panel in Darwin and Alice Springs. This has informed our strategic priorities for the next 20 years as discussed in Chapter Three.

Figure 16 – Vision of customers in our Alice Springs and Darwin People Panels

2.4 Values and trade-offs

A key focus of our engagement sessions has been trying to unpack the values and vision of our customers and how this has influenced the feedback provided. This has helped us make decisions on complex trade-offs when developing this Draft Plan.

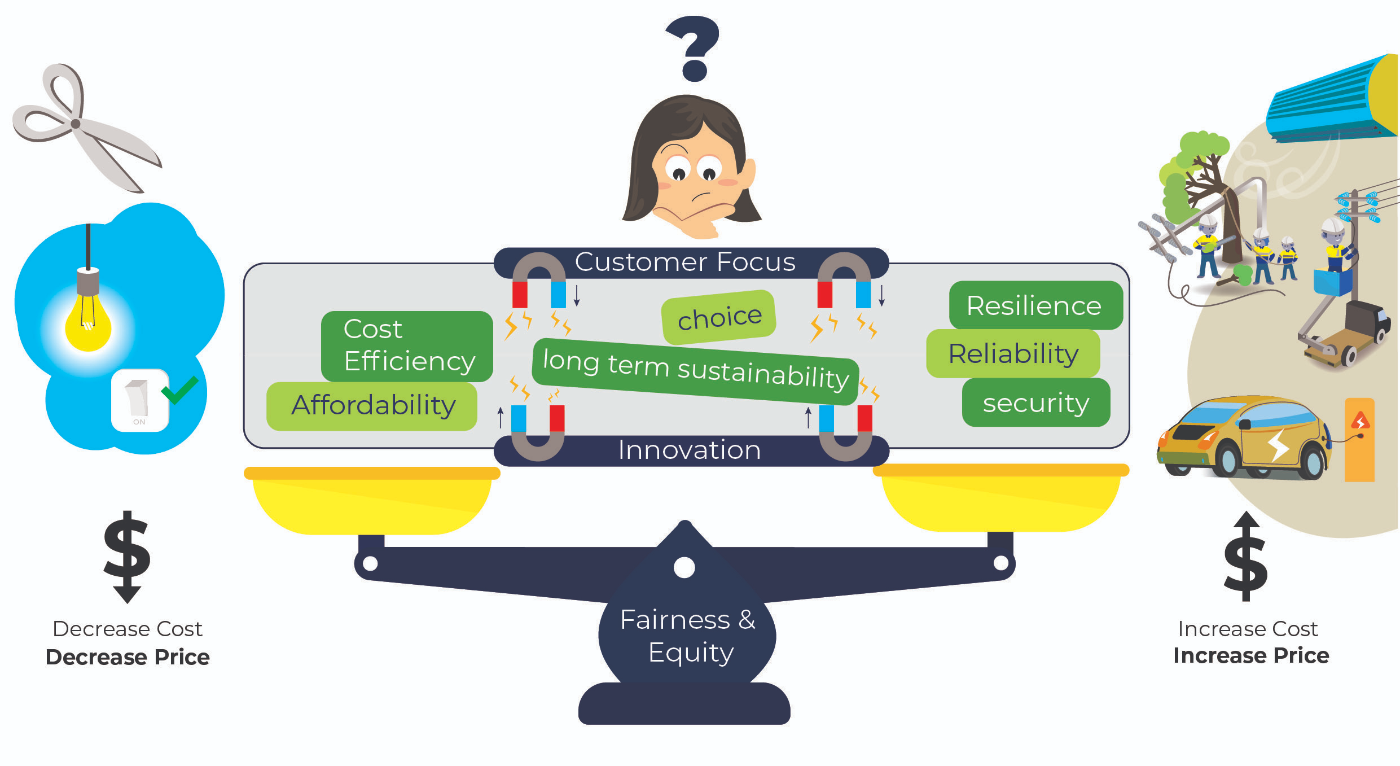

In our initial People’s Panels, we explored the key values customers thought were essential for our business to consider. The conversation showed there were multiple values that were important to customers including affordability, sustainability, measures of network performance such as reliability and security, cost efficiency, equity and fairness and choice.

We also discussed the relative trade-off in values that may bear on decisions and feedback as depicted in Figure 17. For example, our customers recognised that improving affordability could come at the cost of reliability and long-term sustainability. There was also an understanding that the relative importance of values can change in different contexts – for example affordability is more important when there are other cost of living pressures.

Overall, our customers considered that all values were important. At the centre of decision making was the issue of affordability, particularly for customers with lower incomes. Customers did not want to see an increase in the electricity bill unless there was a clear need. Customers had a clear expectation that Power and Water will safely manage reliability, safety and security noting that they did not want the network to be ‘run down’.

Customers recognised that Power and Water needs to look to the future when developing the five-year plans, and that this may entail some trade-offs with short term affordability.

Figure 17 – Customers values and trade offs

2.5 Customer preferences on key issues

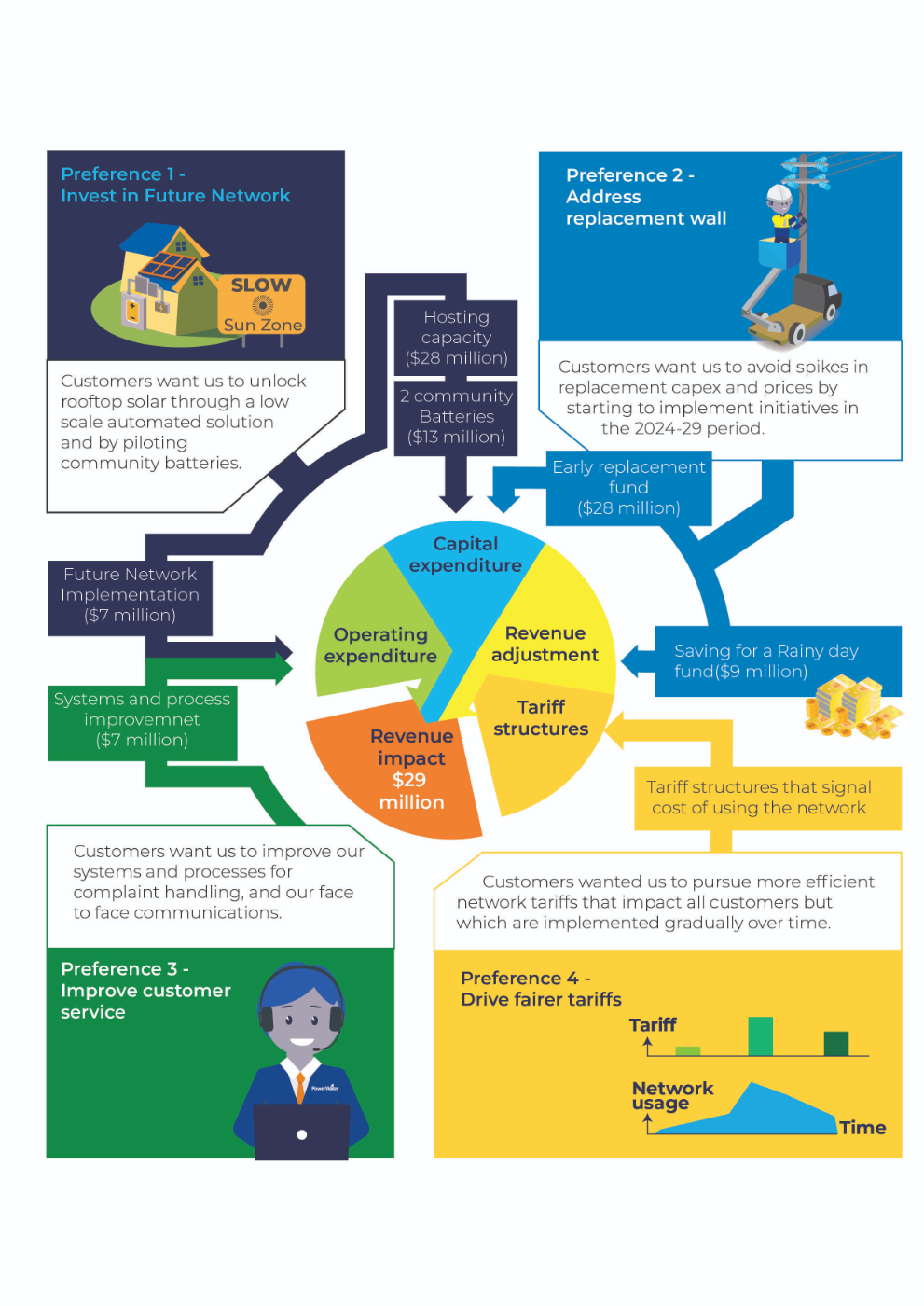

In our People's Panels sessions in Darwin and Alice Springs, our customers provided feedback on the direction we should pursue on key strategic areas. Figure 18 identifies each of the four priorities and how they have been embedded in our expenditure, revenue and tariff plans for the 2024-29 period.

In our discussions on preferences, we sought to understand how our customers were weighing up and trading off values. This was to ensure that customers understood the implications of preferences, but also to provide us with a deeper understanding of what is important to customers in making our business decisions.

Customer Preference One – Future Network

A consistent theme in our customer consultations was the need to facilitate increasing renewables on the energy system in the NT.

We explained to customers the difficulties in managing two-way flows on the network due to voltage issues and minimum demand and noted this would mean more of our new customers may face constraints in how much they can export. We also noted that constraining exports would mean a lost opportunity for all customers due to the relative low cost of solar compared to thermal generation.

We provided options to customers on solutions that could unlock and store more solar. The general view of our People's Panels was that we should invest more to facilitate and support solar where technologies are proven and that we should move forward by piloting new technologies. Community outcomes should be considered to ensure no one is left behind.

The Draft Plan includes additional expenditure to support our Panel’s preferences including:

- Hosting capacity program (estimated $28 million capital expenditure) in our growth capital program. We are currently working through a business case where we are developing a scalable hosting solution that will increase the ability of the network to increase exports over the 2024-29 period.

- Community batteries (estimated $13 million capital expenditure) in our growth capital program. We are undertaking a business case assessment on community batteries in Darwin and Alice Springs.

- Step changes in our operating expenditure related to enabling future network initiatives ($4 million) and ICT opex ($3 million).

Customer Preference Two – Addressing replacement wall

Our People's Panels wanted us to maintain the health of the network for the long term. In our discussions, we noted that significant renewal of the network will be required over the next 20 years to replace the high proportion of assets installed after Cyclone Tracy in 1974. These assets are likely to reach the end of their technical life between 2030 and 2040, with about a third of assets over 50 years of age by 2040. We noted that a sudden uplift in replacement capex would lead to a spike in our electricity revenue in that period and cause affordability issues if passed on to customers.

We noted that our replacement plans for the 2024-29 proposal were focused on replacing assets where the risks exceed the costs. We noted alternative options to address the potential spike in replacement needs and revenue beyond 2030 including bringing forward replacement and a saving fund for future replacement. Our customers considered that a combination of these alternative options should be pursued.

The Draft Plan includes two initiatives to implement the preferences of our People's Panels.

- In our capital plans, we have included a replacement fund of $28 million in the last three years of the 2024-29 period to replace assets that could technically be deferred to beyond 2030 with minimal risk. The replacement fund adds about 10 per cent more to our forecast replacement capex.

- In our revenue adjustments, we have included a “saving for a rainy day fund” equivalent to one per cent of annual revenue in each year of the 2024-29 regulatory period. This adds $9 million of revenue to the 2024-29 period.

Figure 18 – Customer preferences and impact on our five-year plans

Customer Preference Three – Improving customer service

Our People's Panels raised issues with our customer complaint process. Our Alice Springs Panel also considered that the closure of our shopfronts had restricted face to face communications with our staff.

In our discussions on the complaint process, we discussed potential options that may improve the process, including minor improvements to our process and systems, a dedicated officer within Power and Water or appointing an independent person to decide before the matters go to the Ombudsman. The Panels noted we need to do more than currently. They asked that we consider systems which provide more feedback on complaints, better communication on existing options to integrate with face-to-face engagement, and refinements to the existing telephone system to provide feedback on whether enquiries were addressed.

The Panels recognised that shopfronts were costly and noted that we currently provide all customers with an option to meet face-to-face with our staff. They also noted our current arrangements to visit the customer if requested. The Panels considered Power and Water should look at ways to increase face to face options for customers, including better communication, and consider joint initiatives with other energy partners such as Jacana.

The Draft Plan includes a step change in our operating expenditure program ($4 million) for new systems and processes to activate customer preferences on improving customer service.

Customer preference Four – Fairer tariffs for all customers

Our People's Panels recognised that all customers could benefit from price signals that indicate the cost of providing network services. While they understood that small customers do not see the network component of tariffs on their electricity bill, they still saw a need for driving more efficient tariffs.

Our Panels were provided with options on the speed and intensity of tariff reform for the 2024- 29 regulatory period. The Panels noted that tariff reform may disadvantage low income households who cannot change their energy consumption patterns. For this reason, they opted for more incremental reform. However, they were of the view that all customers should be impacted by changes in tariff structures.

In total, the customer preferences have added $29 million of revenue to our forecast for the 2024-29 period.